As per the 92nd Survey of Project Investment in India, new project investment declined for the second consecutive quarter. During the quarter ended Sept 2023 (Q2/FY24), fresh investment proposals declined by 12.98 percent on a Q-o-Q basis and by 21.46 percent on a Y-o-Y basis. The decline was observed across all major sectors except the irrigation sector. A sharp fall in fresh investment in the Manufacturing sector and the central government-sponsored projex are the main reasons for the overall fall in fresh investment seen in Q2/FY24. Further, the fall in investment commitment in the latest quarter is on top of the 45.84 percent fall recorded in the first quarter of FY24 (Q1/FY24) on a sequential basis.

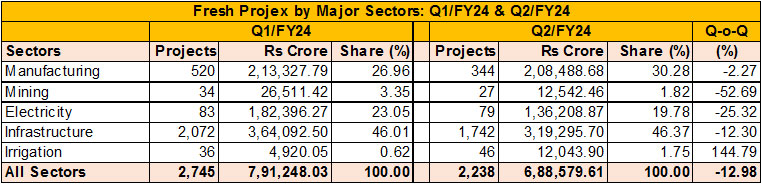

In all, 2,238 new projects with an aggregate investment intention of Rs 6,88,579.61 crore were announced in Q2/FY24 as against 2,745 new projects worth Rs 7,91,248 crore announced in the preceding quarter, indicating a fall of 12.98 percent in terms of aggregate investment and a fall of 18.47 percent in terms of number of new projects.

The scenario worsens when one compares the Q2/FY24investment figures with a year ago statistics. During Q2/FY23, the country had seen the announcement of 2,564 projects worth Rs 8,76,723.66 crore. The Y-o-Y comparison indicates a decline of 21.46 percent in terms of project cost and 12.71 percent in terms of new projects.

In this survey, we have limited our study to a quarter-on-quarter comparison of investment figures to gauge the recent developments in the project investment arena.

Projex by Ownership

In recent times, the Indian public sector acted as the torch bearer in driving the project investment cycle. However, in the first two quarters of the current fiscal 2023-24, government investment seems to have lost steam. Fresh investment intentions by the Government sector declined by 25.59 percent in Q2/FY24 on a Q-o-Q basis. This follows a 3.2 percent decline in the preceding quarter.

In the latest quarter ended September 2023, fresh investment by the State government owned agencies experienced a decline. After a remarkable quarterly investment of Rs 2,03,322.22 crore in Q1/FY24, state agencies unveiled 1,044 new projects worth Rs 1,93,727.01 crore in Q2-FY24, reflecting a decrease of 4.72 percent on a Q-o-Q basis. This decrease follows a period of impressive growth in the previous quarter, where state agencies recorded a 22.38 percent increase in fresh investments compared to the Q4/FY23 period.

Conversely, fresh investment intentions by the Central government agencies have been on a declining trend, with a 47.43 percent reduction in Q2/FY24. This decline follows a 20.57 percent decrease in the previous quarter. After committing a total of Rs 2,44,517.46 crore in fresh investments in the final quarter of FY23, these commitments sharply declined to Rs 1,94,214.52 crore in Q1/FY24, and further dropped to Rs 1,02,094.83 crore in Q2/FY24.

In Q1/FY24, the Private sector witnessed a sharp decline in investment commitments, however, it managed to maintain the status quo in Q2/FY24, by restricting the decline to just 0.24 percent.

During the last quarter of FY23, the Indian private sector, along with foreign companies, achieved a remarkable milestone by announcing Rs 10,50,293.70 crore in investment across 830 new projects. This included several high-value projects in sectors such as Green Hydrogen, Semiconductors, and Hydel power. However, in Q1/FY24, they could not maintain the tempo. Despite announcing a greater number of projects, investment commitments experienced a significant downturn of 62.51 percent on a quarter-on-quarter basis. Nevertheless, in the subsequent quarter ending in September 2023, they managed to mitigate the decline to just 0.24 percent. In comparison to the Rs 3,93,711.29 crore in fresh investments announced in Q1/FY24, the sector attracted new investment outlays of Rs 3,92,757.77 crore in Q2/FY24.

One of the primary factors contributing to the decline in private sector investments is the reduction in the number of mega projects. The count of mega projects (with a cost of Rs 1,000 crore or more) decreased from 95 projects valued at Rs 9,45,476 crore in Q4/FY23 to 69 projects worth Rs 2,79,914 crore in Q2/FY24.

Projex by Sectors

In the quarter ended September 2023, fresh investments across various major sectors experienced declines.While the Manufacturing sector saw a modest decrease of 2.27 percent, the Mining sector suffered a substantial decline at 52.69 percent. The Electricity and Infrastructure sectors, after showing positive growth in the first quarter of the fiscal year, registered declines of 25.32 percent and 12.30 percent, respectively, in Q2/FY24 on a quarter-on-quarter basis.

Manufacturing:

Within the Manufacturing sector, while Cement, Iron & Steel, and Electronics sectors attracted increased fresh investments, other sub-sectors like Food Processing, Textiles, Pharma, Petrochemicals, and Automobiles saw declines in fresh investment on a Q-o-Q basis.Sharper declines in other major sectors helped the Manufacturing sector to increase its share in total fresh investment from 26.96 percent in Q1/FY24 to 30.28 percent in Q2/FY24.

Apart from the Rs 1,300 crore agro-processing unit of Polo Queen in Maharashtra, the Food Processing sector saw the announcement of 39 new distilleries with a total outlay of Rs 8,760 crore. Most of these distilleries are set up to manufactureEthanol.

To meet the increased demand from the Construction and Infrastructure sectors, 17 more new cement projects with a total capacity of 56.8 mln tpa were announced. Of the seven mega Cement projects, six were by the ACC/Ambuja of the Adani group, involving total investment of Rs 19,594 crore to create new cement manufacturing capacity of 37.8 mln tpa.

In the Iron & Steel sector, there were 69 projects announced, with the most prominent being the Rs 75,000 crore project of JSW Utkal Steel. The company intends to expand its Jatadhar unit capacity in Odisha. Eight more mega projects were announced in this sector.

The Electronics sector, which hasattracted high-ticket projects in the recent past, saw four more mega projects being lined upin the second quarter of FY24. Of this, the projects of Kaynes, HCL, and Advanced Systems were for manufacturing Semiconductor chips and fabrications. Foxconn along with setting up a mobile components plant in Tamil Nadu has also firmed up plans to set up a Semiconductor plant.Avaada Electro intends to invest around Rs 27,000 crore to set up Solar Cells, Modules, Ingots, and Wafers manufacturing plants in Madhya Pradesh and Odisha.

The Automobile sector, where fresh investment declined sharply in this quarter on a Q-o-Q basis, attracted a couple of large-scale investment proposals. Ashok Leyland intends to set up a greenfield Bus manufacturing unit in Uttar Pradesh at a cost of Rs 1,000 crore andthe passenger car major, Hyundai Motor intends to set up a new unit at Talegaon, Maharashtra.

Hindalco of the Aditya Birla group announced plans to set up a Rs 2,000 crore Railway passenger coaches manufacturing unit and the Baxi group intends to set up a Rs 1,005 crore auto component unit. Both the projects would be located in Rajasthan.

Electricity:

After witnessing heavy investment commitments in Solar and Pumped Hydel Power projects in the recent past, fresh investments in the Electricity sector declined by 25.32 percent in the quarter ended September 2023. As against 83 new projects worth Rs 182,396.27 crore announced in Q1/FY24, 79 projects worth Rs 1,36,208.87 crore were announced in Q2/FY24. As seen in the preceding quarter, the bulk of the investment was for setting up Hydel and Solar power projects.

The first quarter of FY24 saw the announcement of 33 Pumped storage hydel power projects costing Rs 1,45,318.97 crore. Apart from PSUs couple of private promoters also expressed their intentions to venture into thiscapex-heavy and long-gestationsegment. The trend continued in the second quarter too, albeit at a slower pace,with 21 more Hydel power projects worth Rs 84,246.86 crore announced.

Similarly, as against 46 Solar/Wind power projects worth Rs 36,177.30 crore announced in Q1/FY24, 55 new Solar/Wind power projects (16,000 MW) worth Rs 34,035.01 crore were announced in Q2/FY24.

Infrastructure:

While both the Central and State Governments contribute to infrastructure investments, a sharp decline of 25.59 percent in the Government sector had an impact on the overall fresh investment in infrastructure. In the second quarter of FY24, the infrastructure sector saw the initiation of 1,742 new projects, representing a total investment commitment of Rs 3,19,295.70 crore. A notable decrease in new investments from Central government agencies resulted in a 12.30 percent reduction in the total investment, as compared to the previous quarter.

Among the sub-sectors, the Roadways saw the announcement of 315 new projects worth Rs 57,550.38 crore.This marked a decline compared to the previous quarter, with 140 fewer projects, resulting in a 56.33 percent decrease in total investment.One of the prominent investors in the sector, the National Highways Authority of India announced 27 new highway projects worth Rs 14,883 crore in Q2/FY24, a sharp decline when compared with Rs 36,536 crore fresh investment in Q1/FY24. One of the largest roadwayprojectsof the quarter was announced by PWD, Maharashtra. It intends to set up a 135.91 km highway between Neral and Shirur at a cost ofRs 11,989.92 crore.

The steep fall in fresh investment in the Roadways sector was offset by a substantial increase in fresh investment in the Railways sector. As against Rs 11,113.84 crore of investment recorded in Q1/FY24, the sector saw the announcement of 41 projects worth Rs 73,631.60 crore in Q2/FY24. The bulk of the total investment wasaccounted for by the Phase-III projects of the Hyderabad Metro Rail. PartsA, B, and C of the project is expected to cost Rs 60,000 crore. The other mega project was the Rs 10,570 crore Trinity Metro Rail in Chandigarh.

The Construction sector comprising Commercial Complexes, Real Estate, and Industrial Parks saw a fall of 19.03 percent in fresh investment on a Q-o-Q basis. The steepest decline was seen in the Commercial Complex segment, with a 29.58 percent decrease in new proposals. In the Real Estate sector, where fresh investment has been on the rise since last year, 437 new projects worth Rs 67,777.29 crore were announced, indicating a decline of 17.85 percent. In the preceding quarter, 532 new projects worth Rs 82,507.50 crore were announced.Fresh investment in the Industrial Parks sector also declined by 17.85 percent on a Q-o-Q basis.

Among the other sub-sectors, while fresh investments in Community Services increased by 10.35 percent, the same in the Water Supply Scheme segment declined by 13.7 percent on a Q-o-Q basis. State government investments have a dominant presence in both sectors.

Mining:

Within the mining sector, both Coal mining and Oil & Gas exploration sectors did not see many mega projects announced in Q2/FY24. As a result, the quarterly total fresh investment in this sector came down from Rs 26,511.42 crore in Q1/FY24 to Rs 12,542.46 crore in Q2/FY24.

Notable projects in this sector included aRs 2,466 crore oil exploration project of Sun Petrochemicals, and Rs 2,278.66 crore four coal handling projects of Central Coalfields and Mahanadi Coalfields.

Projex by States

A quarter-on-quarter analysis of fresh investment attracted by Indian states indicatedthat some of the traditionally top-ranking states experiencedsignificant declines in fresh investment in the quarter ended September 2023.

Among the large states,Chhattisgarh, Maharashtra, Punjab, Uttarakhand, and Gujarat were the major losers. These states witnessed fresh investments halving in Q2/FY24 compared to the preceding quarter's statistics.In contrast, Odisha, Rajasthan, Telangana, Bihar, and Haryana managed to buck the declining trend and recorded healthy growth in fresh investment on a Q-o-Q basis.

Odisha topped the table of fresh investment in Q2/FY24 with 108 projects worth Rs 1,31,946.65 crore and cornered around 19.16 percent of the total fresh investment announced in the September 2023 quarter. The state owes its number one position mainly tothe three mega projects – a Rs 75,000 crore steel project of Jindal Utkal, a Rs 12,000 crore Inland waterways project of Inland Waterways Authority of India, and a Rs 11,300 crore Solar cells and Modules project of Avaada Electro.

Odisha was followed by the southern state, Telangana, with a share of 13.87 percent.A Rs 60,000 crore investment commitment by the Hyderabad Metro Rail accounted for around 63 percent of the total fresh investment of Rs 95,481.31 crore the state attracted in Q2/FY24.

Despite a decrease in fresh investment compared to the previous quarter, Maharashtra, Karnataka, and Uttar Pradeshsecured the third, fourth, and fifthpositions, respectively. Maharashtra attracted 436 new projects (the largest among the states) worth Rs 78,550.07 crore. While Karnataka could attract 123 projects worth Rs 53,565.11 crore, Uttar Pradesh secured 148 new projects worth Rs 43,585.90 crore.

Gujarat, one of the traditional toppers in attracting fresh investment had to settle for eighth place with 222 new projects worth Rs 34,310.55 crore.

Outlook for H2/FY24

The outlook for the second half of the fiscal year 2023-24 (H2/FY24) suggests a mixed landscape for fresh investment activities in India.

With four major states - Chhattisgarh, Madhya Pradesh, Rajasthan, and Telangana entering the election mode, not much fresh capex activities could be seen in these states in Q3/FY24. Hence, the overall fresh capex from the state governments would remain tepid in the third quarter.

Conversely, after the decline observed in Q2/FY24, we may see increased capex announcements from the Central government agencies in the next two quarters.

However, the deteriorating geo-political situation, coupled with decreasing world demand would prompt private companies, especially mid-sized ones, to adopt a cautious wait-and-watchapproach in Q3/FY24. Large private companies that have previously announced sizeableamounts of fresh investment intentions in key sectors like Green Hydrogen, Cement, Steel, Electronics, Automobiles, Real Estate, and Renewable energy sectors may seek government support in grounding their projects in the second half of this fiscal.

Given this investment landscape, the role of the Central government in pump-priming project investment and extending support to the private players in executing their projects would play a crucial role in shaping the capex curve in the second half of fiscal 2023-24.

About Projects Today

Projects Today is India's largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

"Time to Deliver: Veterans Deserve Action, Defence Needs Reform"... Read more