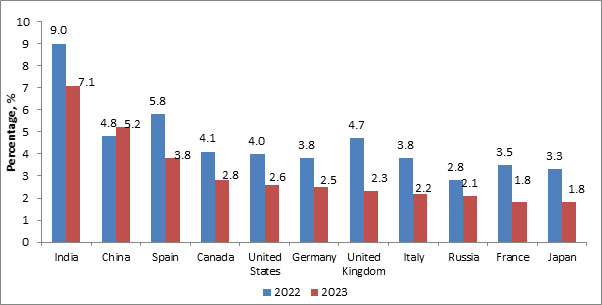

The performance of key economic and business indicators reflects that the Indian economy has resumed its normal growth trajectory and now the economy is poised to enter a new growth orbit invigorated by unrelenting support by the Government and Industry. India’s GDP growth is estimated to be highest in the world for current financial year as well as for the next financial year by various national and international forecasting organizations.

Source: PHD Research Bureau, PHDCCI, compiled from IMF World Economic Outlook, January 2022

Though recent geo-political developments can have some impact on Indian economy through the increase in raw material prices vis-à-vis imports of crude oil, depreciating rupee and inflation, the other channels such as exports and finance will not face any major impact as India’s exports towards Russia and Ukraine are not that much strong; our total exports to Russia and Ukraine are less than USD 3 billion in a year. Notwithstanding the trade channel, our other external indicators are significantly strong such as adequate forex reserves ( Around USD 631 billion on Feb 25,2022 ), strong FDI inflows (more than USD 54 billion in April-November 2021) and a normal CAD (1.3% of GDP in Q2 FY 2022. Banking sector is resilient and there is adequate liquidity of Rs. 7 lakh crore in the economy.

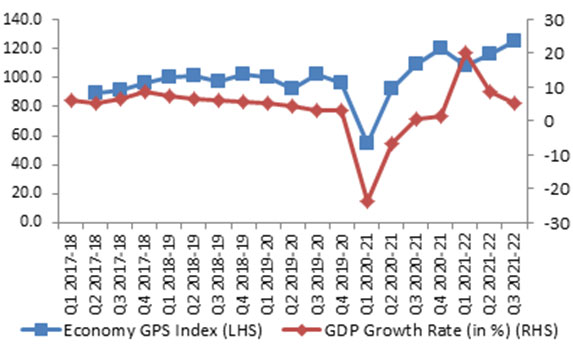

The PHDCCI Economy GPS Index for February 2022 has increased to 134.5 as compared to 133.2 for January 2022, marking the highest of FY 2022. Economy has shifted tracks towards the higher growth trajectory in the month of February 2022 supported by a strong and sustained performance of the key economic indicators.

PHDCCI Economy GPS Index captures the momentum in supply side business activity through growth in GST collections, demand side consumer behaviour through volume growth in passenger vehicle sales and sensitivity of policy reforms and impact of domestic and international economic and business environment through the movement of SENSEX at the base year of 2018-19=100.

Passenger vehicles growth, which is a significant demand indicator in GPS index, has recorded a sequential growth of 19.1%, increasing from 254,287 units in January 2022 to 302,756 units in February 2022. Though February 2022 has been the fifth month when GST collections have crossed Rs 1.30 lakh crore mark, the sequential growth of GST collections has decreased by 5.6% from Rs. 140,986 crore in January 2022 to Rs. 133,026 crore in February 2022. The sequential growth of SENSEX (average of daily close) has also decreased by 3.2% in February 2022 from 59586 in January 2022 to 57698 in February 2022 amid the geo-political tensions, majorly the Russia-Ukraine war.

| PHDCCI Economy GPS Index 2018-19=100 | Feb 2021 | Mar 2021 | Apr 2021 | May 2021 | Jun 2021 | Jul 2021 | Aug 2021 | Sep 2021 | Oct 2021 | Nov 2021 | Dec 2021 | Jan 2022 | Feb 2022 |

| 118.8 | 122.9 | 124.3 | 91.5 | 107.5 | 119.7 | 116.7 | 113.1 | 127.0 | 125.2 | 123.5 | 133.2 | 134.5 |

Source: PHD Research Bureau, PHDCCI Economy GPS Index.

The PHDCCI Economy GPS Index during the period April–February of FY 2021-22 stands at 119.6, which is 28.1 points higher than April–February FY 2020-2021 period index of 91.5. The PHDCCI Economy GPS Index at 134.5 for February 2022 is higher by 15.7 points from the Economy GPS Index for February 2021 at 118.8.

| PHDCCI Economy GPS Index 2018-19=100 | February 2018 | February 2019 | February 2020 | February 2021 | February 2022 |

| 93.6 | 98.8 | 103.2 | 118.8 | 134.5 |

Source: PHD Research Bureau, PHDCCI Economy GPS Index.

PHDCCI Economy GPS Index has shown sharp recovery from the lows of 39.6 for April 2020 to 124.3 for April 2021, 91.5 for May 2021 as compared with 50.1 for May 2020, 107.5 for June 2021 as compared with 75.1 for June 2020, 119.7 for July 2021 as compared with 85.6 for July 2020, 116.7 for August 2021 as compared with 90.5 for August 2020, 113.1 for September 2021 as compared with 100.2 for September 2020, 127.0 for October 2021 as compared with 109.6 for October 2020, 125.2 for November 2021 as compared with 106.9 for November 2020, 123.5 for December 2021 as compared with 111.9 for December 2020, 133.2 for January 2022 as compared with 118.5 for January 2021 and 134.5 for February 2022 as compared with 118.8 for February 2021.

Source: PHD Research Bureau, PHDCCI Economy GPS Index.

Going ahead, the pace of economic activity is expected to remain strong on the back of various structural reforms undertaken by the Government during the last 2 years. The recent budget announced by the Government for the FY 2022-23 looks into the future while keeping a close eye on the ground. The Budget is a step forward towards the vision of creating an Aatmanirbhar Bharat and reflects a consistency in government’s approach in making India a Modern, Developed and Inclusive nation.

Reforms such as emergency credit line for MSMEs, liquidity scheme and partial credit guarantee schemes for NBFCs, Production Linked Incentive Scheme for 14 champion sectors, structural reforms in growth promising sectors including coal, minerals, defence, airports and aerospace management, power, space sector, atomic energy sector and civil aviation, among others, have made recovery sooner than expected. And fortunately, all these reforms have been given a great push by the focus on ‘Amrit Kaal’ of next 25 years - from India at 75 to India at 100, as depicted in the Union Budget 2022-23. This has provided a great zeal and enthusiasm to move forward from present state of affairs with a lot of structural reforms and support from inherent strong fundamentals of Indian economy.

Going ahead, the drivers of household consumption need to be further strengthened to enhance the aggregate demand as it will have an accelerated effect on expansion of capital investments. Further, the high rate of inflation has become a major challenge, escalated by the recent geo-political developments. At this juncture, there is a need to address the high commodity prices to support the consumption and private investments in the country. A continued reforms momentum would be crucial for a strong pace of economic activity and a sustainable growth trajectory of Indian economy in the coming months.

(Dr. S.P. Sharma is Chief Economist & Director of Research • PHDCCI (PHD Chamber of Commerce and industry, India)

Disclaimer: The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.

"India’s GDP Grows 7.8% in Q1, 8.2% in Q2 and 8% in H1 2025-26"... Read more